《If you import goods from China to US, HTS3924…apply the refund》

2022-07-13 10:51

-Customer A-

While I chatted with my US customer John(Not real name) on 20th May 2022,

He asked me a question: Do you know tariff exemption is revived on hand shower (shower head) right?

That I said I don’t know.

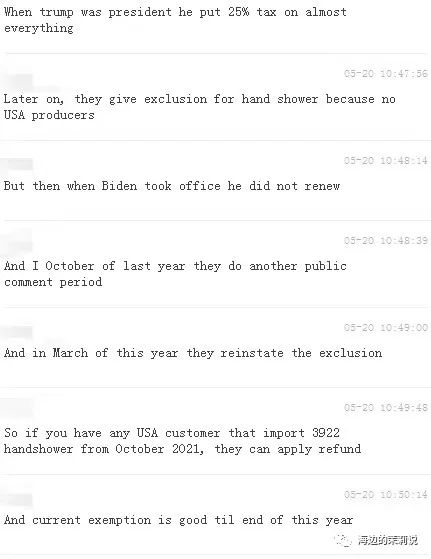

And he explained for me patiently as below picture:

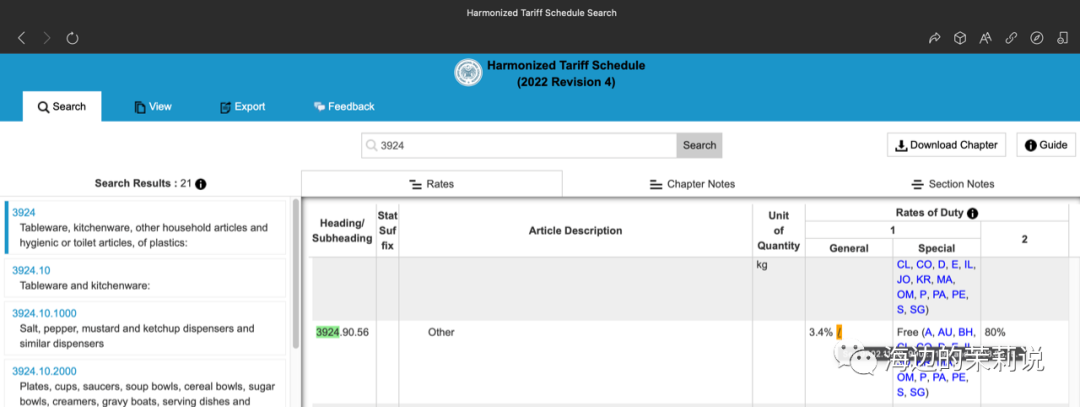

What he said means If you have imported shower head products (HTS start from 3924 or may be 3922…) from China to US since October 2021 till this year, you can try to apply the refund as tariff exemption is revived.

-Customer B-

After chatting with John, I showed tariff exemption information to customer B.

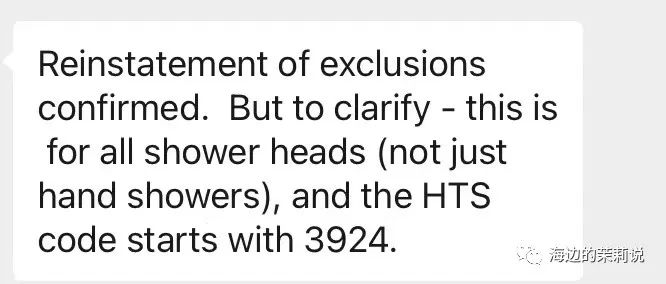

B is surprised and he said he will look into that, the day after 20th May, he replied me as below picture:

What he replied means the Reinstatement of Exclusions is confirmed, but HTS starts with 3924.

-Customer C-

As above picture, customer C approved Reinstatement of Exclusions also.

Whatever, If you do import from China to US since October 2021, they are something about 3922, 3924…, you can contact forwarder for more details to apply refundto as tariff exemption exclusion reinstate.

If you don’t know your HTS, try to ask your supplier or forwarder.

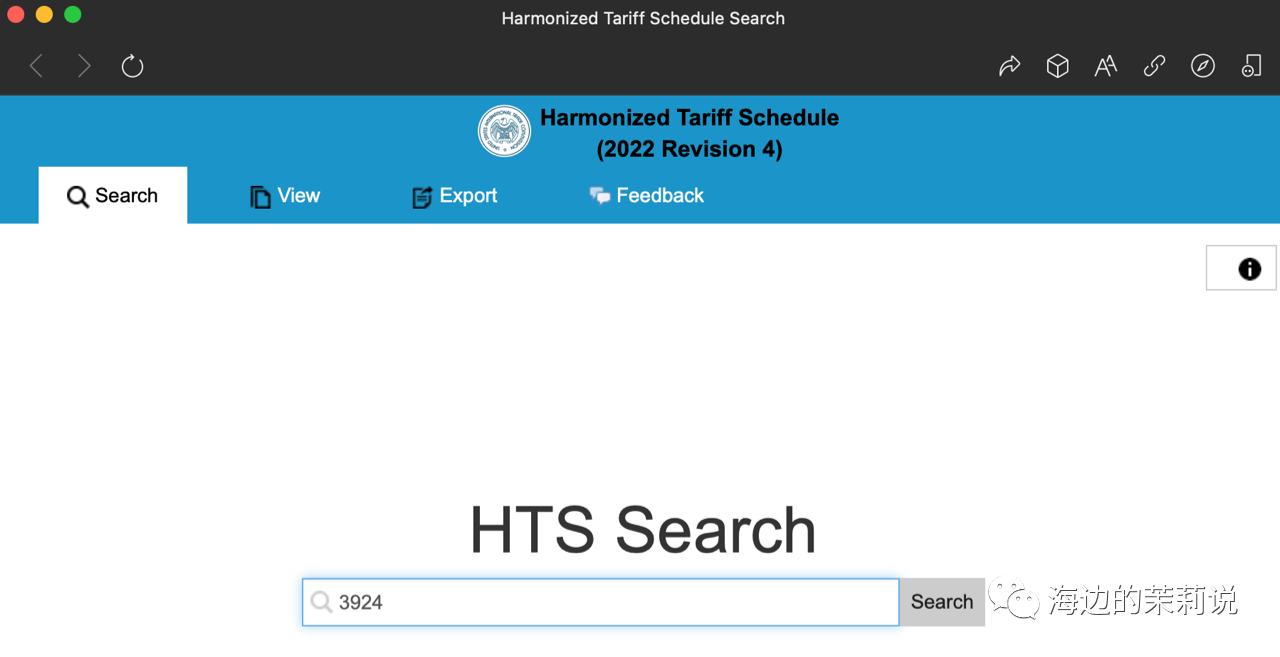

And check the tax rate from website: https://hts.usitc.gov/

Enter your HTS into “Enter your search query”

2. Find the rate from “1”, “General” (tax rate for China), the extra tax from “/“ beside tax rate.

If this article help you and you like it, give me a like bottom and follow me below, thanks.

Get the latest price? We'll respond as soon as possible(within 12 hours)